The implications of the British vote to leave the European Union are far-reaching in the global economy, but Green Mountain Power customers might be surprised to hear that the vote is affecting them too: It will mean cheaper rates for them next year.

That’s because of the way regulators set the rates for the state’s largest utility.

A big part of what makes up customer rates for utilities in Vermont is the amount they can charge customers for the infrastructure they've invested in.

That's stuff like poles, wires, trucks, substations and other infrastructure that helps the utility deliver its service to customers.

Instead of making customers pay in full for these (sometimes costly) investments right away, regulators let the companies charge a percentage of the value of that infrastructure every year.

That way, customers are paying back those poles, trucks and substations over time, and there aren't big swings in rates every time utilities buy or upgrade something.

That percentage of the value of the company’s infrastructure that customers pay for is known as the utility’s “Return on Equity.”

Department of Public Service Commissioner Chris Recchia says this percentage is also an important mechanism for regulating the rates that customers pay.

“You can range from in the 8 percent range to 10 or 12 percent,” Recchia says, “and depending on the economy and how investments are being made elsewhere in the economy, that rate they should be entitled to might be lower or higher.”

Normally, Recchia's department has to negotiate the Return on Equity with utilities. Both sides make a case for why it should be lower or higher, and if they can't agree, then regulators at the Public Service Board have to decide what percentage seems fair. The process can be time-consuming and expensive (which is important, because the costs associated with regulatory proceedings are billed to customers).

Green Mountain Power's rate of Return on Equity is set differently because the company uses "Alternative Regulation."

That means that instead of revising the percentage every few years in normal rate cases like most companies do, GMP has its Return on Equity recalculated annually.

The other difference is that nobody’s negotiating.

"You want to have what's happening for our business tied to what's happening in the economy." — Kristin Carlson, Green Mountain Power

“Our Return on Equity is tied to the 10-year treasury note yield,” says Green Mountain Power spokeswoman Kristin Carlson.

The company's Return on Equity is set every year using a mathematical formula, not negotiations. The formula uses the 10-year Treasury note yield to determine how much customers should have to pay for all the stuff Green Mountain Power owns.

“That is the interest rate that the U.S. government pays to borrow money for different lengths of time,” Carlson says. “The higher the yield, the better the economy; the lower the yield, the worse the economy.”

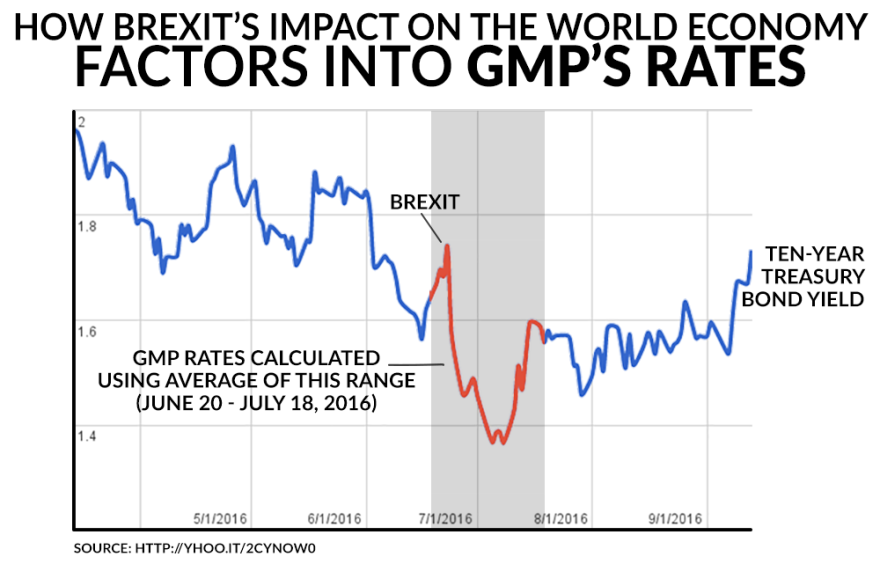

So GMP's Return on Equity is set based on how much those government bonds are paying out, on average, over about a month from June to July.

This year, that average was measured between June 20 and July 28. The Brexit vote was June 23.

“When Brexit hit, it shook the world market, which impacted the U.S. Treasury yield note, which lowered our Return on Equity,” Carlson says.

The company's Return on Equity came down from 9.44 percent to 9.02 percent in next year's rates.

The reduction means GMP customers will pay the company $4.8 million less next year than they would if the rate were unchanged.

Carlson says that's one of the benefits of these annual check-ups under Alternative Regulation.

“Because you want to have what's happening for our business tied to what's happening in the economy,” she says.

At the Department of Public Service, Chris Recchia says that wouldn't happen under Traditional Regulation, where utilities are allowed to go years without checking in with regulators.

“If a utility is not present for 10 years and doesn't come in for a rate change, it probably means that they're doing OK. And it probably means that ratepayers are overpaying at least through portions of that time.”

GMP's overall rates are likely to go up slightly next year, mostly because of outside forces like the regional energy market.

But if it weren't for Brexit, they might be going up more.